What Is Special Event Insurance?

Special event insurance is designed to cover unexpected expenses or disruptions that could impact your special event. This type of insurance policy offers comprehensive protection for various aspects of your event. From a one day event to a festival that lasts over multiple days, special event insurance can protect what you’ve spent months planning for.

With so many moving parts, it’s natural to wonder how to safeguard your special event. At The Huneycutt Group, we’re here to help you protect your special day from unforeseen incidents.

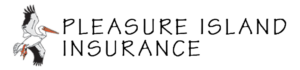

What Types Of Events And Functions Are Covered?

- Wedding ceremonies and receptions

- Rehearsal dinners

- Bridal showers

- Engagement parties

- Concerts

- Sporting Events

- Patries

- Social Events

- Fundraisers

- Trade Shows

- Competitions

- Graduations

If you have unique event needs, our team can help you determine the coverage to suite your event.

What Event Insurance Covers

Special event insurance offers comprehensive protection for a range of risks, so you can relax and enjoy your day knowing you’re covered. Each coverage type plays a unique role, so that every part of your event (wedding, concert, trade show) is covered. Here’s a breakdown of the main coverages available to help you understand the level of protection event insurance offers.

Special Wedding Coverage

Additional options can cover specific risks unique to weddings, like lost rings, damaged wedding attire, stolen gifts, or vendor no-shows. Speak with us at The Huneycutt Group.

Event Liability Coverage

Liability coverage protects you in case someone is injured or property is damaged at your event. This is particularly important if your venue requires proof of insurance.

Event Cancellation Coverage

If an unexpected situation forces you to cancel or postpone your event (such as extreme weather or illness), cancellation coverage helps reimburse non-refundable deposits and other costs.

How Much Coverage Is Needed?

The amount of insurance depends on factors like your special event’s size, location, and overall cost. We recommend evaluating your total budget and the risks associated with your venue to determine adequate coverage.

Our experienced agents can guide you through this process.

How Much Does Event Insurance Cost?

Event insurance costs vary based on coverage needs, location, and other event details. Typically, policies are very affordable, starting at $50.

The Huneycutt Group can provide a personalized quote based on your wedding specifics.

How To Get Proof Of Insurance For Your Event

Once you’ve secured your insurance for your one day special event, getting proof of insurance is a cinch. The Huneycutt Group will provide you with a Certificate of Insurance (COI), which can be shared with your venue or vendors who require it. Need to add someone as an interest? No problem.

How To Get A Quote

Getting the right policy is important! At The Huneycutt Group, we’ll assess your needs and guide you to the appropriate level of coverage for your very special day.

Contact us today for a personalized quote.

Special Event Insurance FAQs

Is Wedding Insurance Required By Venues?

Many venues require liability insurance to cover accidents or damages. Check with your venue to understand their requirements.

Can I Transfer My Policy If I Change the Wedding Date or Venue?

Many policies allow you to make adjustments if your wedding date or venue changes, but you’ll need to inform your insurance provider as soon as possible for continuous coverage.

Can I Get Coverage If I Book Close To The Date Of The Event?

Yes, you can purchase event insurance even close to the date, though some coverage options may be limited. Contact us early to explore your options.

Does Wedding Event Insurance Cover Postponements Due to Weather?

Yes, most wedding insurance policies cover postponements due to extreme weather, as long as it was unforeseen. It’s essential to read your policy carefully to understand which weather events are included.

How Much Wedding Event Insurance Should I Buy?

This depends on your wedding budget and venue requirements. We recommend discussing your needs with an agent at The Huneycutt Group.